California Counties Property Tax Rates . Property taxes in california are applied to assessed values. This is the single largest. California property tax provides an overview of property tax assessment in california. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. Each county collects a general property tax equal to 1% of assessed value. It is designed to give readers a general. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format.

from pbn.com

This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. California property tax provides an overview of property tax assessment in california. Each county collects a general property tax equal to 1% of assessed value. It is designed to give readers a general. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. Property taxes in california are applied to assessed values. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. This is the single largest. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property.

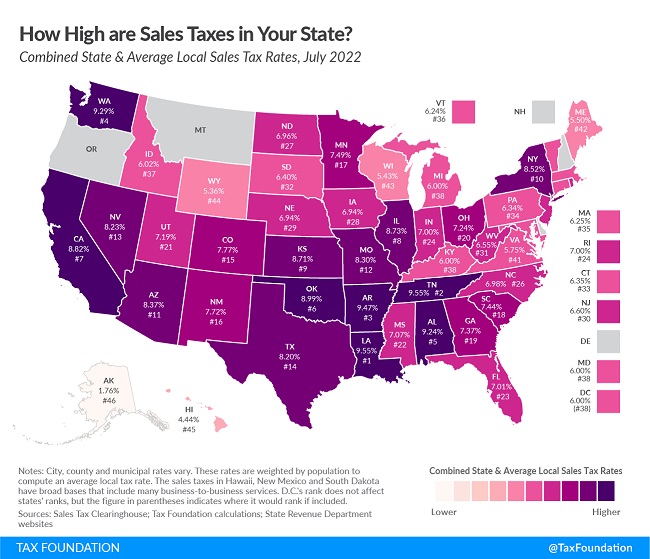

Tax Foundation R.I. state sales tax second highest in country

California Counties Property Tax Rates The maximum property tax rate in california is set at 1% of the assessed value of the property due to. California property tax provides an overview of property tax assessment in california. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. This is the single largest. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. It is designed to give readers a general. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property. Each county collects a general property tax equal to 1% of assessed value. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. Property taxes in california are applied to assessed values.

From mendovoice.com

County property tax bill error affected 850 out of 56,000 invoices sent California Counties Property Tax Rates California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. Each county collects a general property tax equal to 1% of assessed value. California. California Counties Property Tax Rates.

From lao.ca.gov

Differences in Property Tax Revenue for Counties, Cities & Special California Counties Property Tax Rates On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. Property taxes in california are applied to assessed values. The median property tax in california is. California Counties Property Tax Rates.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax California Counties Property Tax Rates The maximum property tax rate in california is set at 1% of the assessed value of the property due to. Each county collects a general property tax equal to 1% of assessed value. It is designed to give readers a general. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format.. California Counties Property Tax Rates.

From lao.ca.gov

Understanding California’s Property Taxes California Counties Property Tax Rates California property tax provides an overview of property tax assessment in california. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. Each county collects a. California Counties Property Tax Rates.

From storage.googleapis.com

How Do I Pay My Property Taxes In San Mateo County California Counties Property Tax Rates This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a. California Counties Property Tax Rates.

From stephenhaw.com

What you need to know about California’s property tax rates The California Counties Property Tax Rates It is designed to give readers a general. Property taxes in california are applied to assessed values. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. California property tax provides an overview of property tax assessment in california. The maximum property tax rate in. California Counties Property Tax Rates.

From lukinski.com

California Property Taxes Real Estate Taxes Explained, List of California Counties Property Tax Rates Each county collects a general property tax equal to 1% of assessed value. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. The maximum property tax rate. California Counties Property Tax Rates.

From www.wrightforshelby.com

Taxes, spending and debt Commissioner Mick Wright California Counties Property Tax Rates Each county collects a general property tax equal to 1% of assessed value. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. It is designed to give readers a general. Property taxes in california are applied to assessed values. On this webpage, find property. California Counties Property Tax Rates.

From www.lao.ca.gov

Understanding California’s Property Taxes California Counties Property Tax Rates Each county collects a general property tax equal to 1% of assessed value. It is designed to give readers a general. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. The maximum property tax rate in california is set at 1% of the assessed value of the property due to.. California Counties Property Tax Rates.

From pbn.com

Tax Foundation R.I. state sales tax second highest in country California Counties Property Tax Rates This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. This is the single largest. Property taxes in california are applied to assessed values. The median property tax in. California Counties Property Tax Rates.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation California Counties Property Tax Rates It is designed to give readers a general. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. This is the single largest. California property tax provides an overview of property tax assessment in california. The median property tax in california is $2,839.00 per year,. California Counties Property Tax Rates.

From taxfoundation.org

State and Local Sales Tax Rates Midyear 2013 Tax Foundation California Counties Property Tax Rates The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and a median effective property. This is the single largest. Property taxes in california are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. The maximum property tax rate in california is set at. California Counties Property Tax Rates.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties California Counties Property Tax Rates California property tax provides an overview of property tax assessment in california. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. This is. California Counties Property Tax Rates.

From www.13wmaz.com

How much would Bibb County Schools increase property taxes California Counties Property Tax Rates On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. Property taxes in california are applied to assessed values. It is designed to give readers a general. This is the single largest. The median property tax in california is $2,839.00 per year, based on a median home value of $384,200.00 and. California Counties Property Tax Rates.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation California Counties Property Tax Rates This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. This is the single largest. On this webpage, find property tax allocations and levies reported by 58 california counties. California Counties Property Tax Rates.

From cumeu.com

Top 14 la county property tax payment inquiry 2022 California Counties Property Tax Rates Property taxes in california are applied to assessed values. California property tax provides an overview of property tax assessment in california. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a. California Counties Property Tax Rates.

From txcip.org

Texas Counties Total Taxable Value for County Property Tax Purposes California Counties Property Tax Rates This is the single largest. The maximum property tax rate in california is set at 1% of the assessed value of the property due to. This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. It is designed to give readers a general. California has 58 counties, with median. California Counties Property Tax Rates.

From www.illinoispolicy.org

Busting the myth that Chicago taxes are low Illinois Policy California Counties Property Tax Rates This interactive table ranks california's counties by median property tax in dollars, percentage of home value, and percentage of median income. On this webpage, find property tax allocations and levies reported by 58 california counties in an open data format. California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low. California Counties Property Tax Rates.